This is a responsible Budget that helps with the cost of living, while Building Australia’s Future.

We are delivering more tax relief for every Australian taxpayer, more energy bill relief and cheaper medicines.

We are strengthening Medicare, investing in housing and education, advancing reforms to make our economy stronger, and building a Future Made in Australia.

The Budget builds on the strong foundations we have laid, helping to secure our nation’s future at a time of global uncertainty.

We know Australians have made sacrifices, and the Albanese Labor Government remains focused on delivering for households.

We’re providing relief now and investing in the future, while delivering the biggest improvement to the bottom line in a single parliamentary term.

This means smaller deficits and much lower debt compared to what we inherited.

The Budget forecasts an improvement in the bottom line over the forward estimates, and a lower deficit in 2025-26.

Treasury also expects inflation to return sustainably to the RBA’s target band six months earlier than previously expected.

Today, because of the work Australians have done together, our economy is turning the corner.

Inflation is down, unemployment is low, real wages are growing again, and interest rates have started to come down.

We’ve achieved this the Australian way – looking after each other, and working together.

Our responsible Budget helps Australians now and builds Australia’s future by:

- Delivering cost of living relief.

- Strengthening Medicare.

- Making it easier to buy and rent a home.

- Investing in every stage of education.

- Building a stronger economy.

Easing the cost of living

The world has thrown a lot of challenges at Australia over the past few years, and helping every Australian with cost of living remains the Government’s top priority.

This Budget delivers:

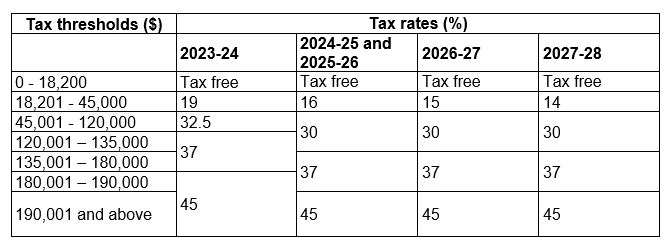

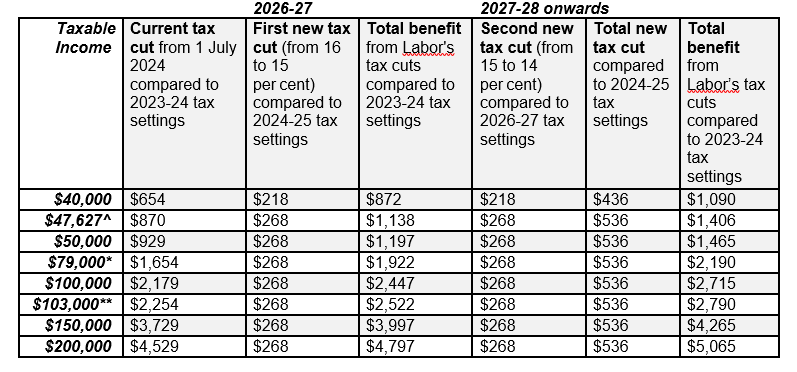

- New tax cuts for every Australian taxpayer.

- Another $150 energy rebate for every household and small businesses.

- Even cheaper medicines by reducing the PBS co-payment.

- Higher wages for aged care nurses.

- A fair go for Australian consumers.

Strengthening Medicare

More bulk billing means less pressure on households.

This Budget delivers:

- $7.9 billion to increase bulk billing so Australians can see a GP for free.

- 50 more Medicare Urgent Care Clinics across Australia.

- $1.8 billion to fund public hospitals.

- $793 million invested to deliver more choice, lower costs and better care for women.

- Hundreds more training places for doctors and nurses.

Making it easier to buy and rent a home

The Budget takes the Government’s total new housing commitments to $33 billion to help us build more homes for Australians.

This Budget includes:

- An expansion of Labor’s Help to Buy scheme.

- $54 million to accelerate the uptake of modern methods of construction to build more homes faster.

- A ban on foreign investors from purchasing existing homes.

- Incentives to train more construction workers.

This is a responsible Budget that helps with the cost of living, while Building Australia’s Future.

We are delivering more tax relief for every Australian taxpayer, more energy bill relief and cheaper medicines.

We are strengthening Medicare, investing in housing and education, advancing reforms to make our economy stronger, and building a Future Made in Australia.

The Budget builds on the strong foundations we have laid, helping to secure our nation’s future at a time of global uncertainty.

We know Australians have made sacrifices, and the Albanese Labor Government remains focused on delivering for households.

We’re providing relief now and investing in the future, while delivering the biggest improvement to the bottom line in a single parliamentary term.

This means smaller deficits and much lower debt compared to what we inherited.

The Budget forecasts an improvement in the bottom line over the forward estimates, and a lower deficit in 2025-26.

Treasury also expects inflation to return sustainably to the RBA’s target band six months earlier than previously expected.

Today, because of the work Australians have done together, our economy is turning the corner.

Inflation is down, unemployment is low, real wages are growing again, and interest rates have started to come down.

We’ve achieved this the Australian way – looking after each other, and working together.

Our responsible Budget helps Australians now and builds Australia’s future by:

- Delivering cost of living relief.

- Strengthening Medicare.

- Making it easier to buy and rent a home.

- Investing in every stage of education.

- Building a stronger economy.

Easing the cost of living

The world has thrown a lot of challenges at Australia over the past few years, and helping every Australian with cost of living remains the Government’s top priority.

This Budget delivers:

- New tax cuts for every Australian taxpayer.

- Another $150 energy rebate for every household and small businesses.

- Even cheaper medicines by reducing the PBS co-payment.

- Higher wages for aged care nurses.

- A fair go for Australian consumers.

Strengthening Medicare

More bulk billing means less pressure on households.

This Budget delivers:

- $7.9 billion to increase bulk billing so Australians can see a GP for free.

- 50 more Medicare Urgent Care Clinics across Australia.

- $1.8 billion to fund public hospitals.

- $793 million invested to deliver more choice, lower costs and better care for women.

- Hundreds more training places for doctors and nurses.

Making it easier to buy and rent a home

The Budget takes the Government’s total new housing commitments to $33 billion to help us build more homes for Australians.

This Budget includes:

- An expansion of Labor’s Help to Buy scheme.

- $54 million to accelerate the uptake of modern methods of construction to build more homes faster.

- A ban on foreign investors from purchasing existing homes.

- Incentives to train more construction workers.

Investing in every stage of education

This Budget invests in every stage of education to support students and build the workforce of the future.

This Budget includes:

- Investments in public schools to put them on a path to full and fair funding.

- $5 billion to expand access to early education and care and fund a historic wage rise for early educators.

- Cuts to student debt and lowering repayments.

- Funding for 100,000 Free TAFE places every year from 2027.

Building a stronger economy

The Albanese Government is building a stronger, more productive and more resilient economy.

This Budget delivers:

- Competition reforms like progressing national occupational licensing for electrical trades.

- Reforms to non-compete clauses for low and middle-income workers to lift affected workers’ wages by up to four per cent or $2,500 a year.

- More support for small businesses, taking Labor’s total targeted small business commitments in this term of Parliament to more than $2 billion.

- More than $3 billion to unlock investment in green metals and manufacturing.

- $17.1 billion to deliver vital infrastructure.

- Up to $3 billion to complete the NBN rollout, supporting suburbs and regions.

Responsible economic and fiscal management

Our responsible economic management has improved the budget position, paid down Liberal debt and made room for the investments that matter to Australians like tax cuts for every taxpayer, a stronger Medicare and more housing.

- The Budget position has improved by $207 billion over the seven years to 2028-29 – the biggest turnaround in the budget in a Parliamentary term.

- We’ve turned two big Liberal deficits into two Labor surpluses in our first two years and the deficit in our third year of $27.6 billion is almost half what was forecast at the last election.

- The deficit in 2025-26 is projected to be $42.1 billion, lower than MYEFO and what we inherited.

- Debt is $177 billion lower in 2024-25 than what was forecast at the last election, helping us avoid around $60 billion in interest costs.

This Budget continues the Albanese Government’s economic plan which is focused on finishing the fight against inflation, delivering responsible cost of living relief and building a stronger economy and stronger budget.

This Budget invests in every stage of education to support students and build the workforce of the future.

This Budget includes:

- Investments in public schools to put them on a path to full and fair funding.

- $5 billion to expand access to early education and care and fund a historic wage rise for early educators.

- Cuts to student debt and lowering repayments.

- Funding for 100,000 Free TAFE places every year from 2027.

Building a stronger economy

The Albanese Government is building a stronger, more productive and more resilient economy.

This Budget delivers:

- Competition reforms like progressing national occupational licensing for electrical trades.

- Reforms to non-compete clauses for low and middle-income workers to lift affected workers’ wages by up to four per cent or $2,500 a year.

- More support for small businesses, taking Labor’s total targeted small business commitments in this term of Parliament to more than $2 billion.

- More than $3 billion to unlock investment in green metals and manufacturing.

- $17.1 billion to deliver vital infrastructure.

- Up to $3 billion to complete the NBN rollout, supporting suburbs and regions.

Responsible economic and fiscal management

Our responsible economic management has improved the budget position, paid down Liberal debt and made room for the investments that matter to Australians like tax cuts for every taxpayer, a stronger Medicare and more housing.

- The Budget position has improved by $207 billion over the seven years to 2028-29 – the biggest turnaround in the budget in a Parliamentary term.

- We’ve turned two big Liberal deficits into two Labor surpluses in our first two years and the deficit in our third year of $27.6 billion is almost half what was forecast at the last election.

- The deficit in 2025-26 is projected to be $42.1 billion, lower than MYEFO and what we inherited.

- Debt is $177 billion lower in 2024-25 than what was forecast at the last election, helping us avoid around $60 billion in interest costs.

This Budget continues the Albanese Government’s economic plan which is focused on finishing the fight against inflation, delivering responsible cost of living relief and building a stronger economy and stronger budget.

An artist’s impression of the waterplay area, which is part of the inclusive Foreshore Park playground project.

An artist’s impression of the waterplay area, which is part of the inclusive Foreshore Park playground project.