The Australian Greens have said today’s budget was a missed opportunity to deliver real cost of living relief by getting dental into Medicare, and to pay for it by making the big corporations pay their fair share of tax, which would have delivered more help than tiny tax tweaks that are 15 months away.

In a wealthy country like ours, everyone should be able to afford the basics – a home, food, and have access to world class health and education.

Instead, many people are struggling to afford the essentials while one in three big corporations is paying no tax.

Labor’s budget has delivered $56 billion in fossil fuel subsidies and $176 billion for wealthy property investors, but failed to deliver the bold reforms needed to support people being smashed by the skyrocketing cost-of-living.

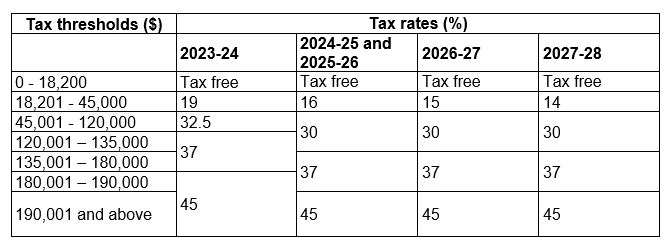

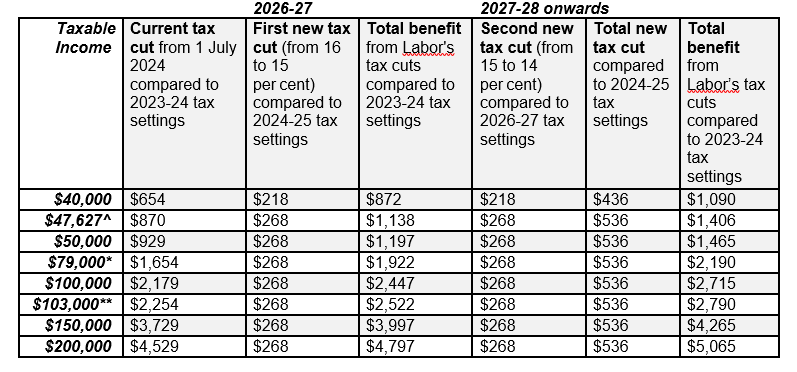

The two new tax cuts announced by the government will barely scratch the surface for people struggling to pay for food or rent, and won’t come into effect for 15 months, with low income workers saving only 73 cents a day, which wouldn’t even cover one cup of coffee per week.

Meanwhile, the government’s previous stage three tax cuts delivered $4,500 in tax cuts for billionaires, with these new cuts increasing those savings to more than $5,000 for billionaires like Gina Rinehart and Clive Palmer.

There are no increases to Job Seeker or Youth Allowance in this budget, meaning the more than one million on these income supports will remain in poverty.

And the government has forecast billions more in cuts to the NDIS.

On housing, the government has fixed some of the problems the Greens have highlighted in the Help to Buy scheme, but there is nothing new for renters, who didn’t even get a mention in the Treasurer’s speech.

Climate and the environment got zero mention in the Treasurer’s speech as well. Perhaps this is not surprising as Labor has approved over 30 coal and gas projects in this term of Parliament alone and is gutting Australia’s environment laws.

The government is also continuing to pour billions of dollars more into nuclear submarines as AUKUS costs increase, with funding in this budget blowing out from $12 billion to $18 billion.

Labor has also broken its promise on refugees, by failing to increase the humanitarian intake.

In a sign that Greens’ pressure works, Labor did commit to adopting part of the Greens’ plan to see the GP for free, by tripling the bulk-billing incentive.

Labor also locked in their commitment to wipe 20 per cent off student debt, a step towards the Greens’ plan to wipe it completely.

Labor has also made a significant investment in women’s sexual and reproductive health, including cheaper contraceptives, more accessible menopause treatment, and investment in the maternal health workforce. This follows a Greens’ campaign including two Greens-initiated Senate inquiries.

However, the Greens say it is disappointing that rather than locking in that cost-of-living relief right now, Labor has used the cover of the budget to do a dodgy deal with Dutton to gut environment and climate laws.

While everyone was focused on the budget, Labor and the Liberals have teamed up to ram through legislation in Parliament to gut our climate and environment laws making it easier for big corporations to trash our precious natural environment and approve more coal and gas.

It shows you can’t keep voting for the same two parties and expecting a different result.

This election the Greens will keep Dutton out and get Labor to act on what people need like getting dental and mental health into Medicare, seeing the GP for free, capping rent increases and lowering mortgages, and taking strong climate action.

The Greens’ previously announced plan to tax the excessive profits of big corporations across different sectors of the economy would raise $514 billion dollars over the next decade.

Leader of the Australian Greens, Adam Bandt MP:

“This tiny tax tweak budget was a missed opportunity to provide urgent cost of living relief, like dental into Medicare. Instead, Labor teamed up with the Liberals to gut our environment laws.

“An extra 73 cents a day in 15 months’ time won’t do much when your rent has already gone up hundreds of dollars a week.

“Billionaires and politicians still end up with tax cuts four times as big as low income earners.

“In a wealthy country like ours, everyone should be able to afford the basics: a home, food, and have access to world class health and education.

“Under this Budget, one in three big corporations pays zero tax.

“We can’t keep voting for the same two parties and expecting a different result.

“We should tax big corporations and billionaires to fund what we all need like getting dental and mental health into Medicare, seeing the GP for free, capping rent increases and lowering mortgages, and taking strong climate action.

“There will be a minority government and the Greens are within reach of winning seats right across the country. Last time there was a minority government, the Greens got dental into Medicare for kids. This is our chance to deliver it for everyone.

“If you want change, the first step is to vote for it.”

Greens Treasury spokesperson, Senator Nick McKim:

“This budget is far more notable for what it doesn’t contain than what it does. It’s a massive, missed opportunity to deliver genuine cost of living relief funded by making ultra-wealthy billionaires and big corporations pay their fair share of tax.

“Instead of colluding with Peter Dutton to weaken Australian environment laws, Labor should have spent this week working with the Greens to put dental into Medicare and better protect our environment.”

Greens Finance spokesperson, Senator Barbara Pocock:

“Australians need cost-of-living relief and a wealthy country like ours can afford world class health and education services.

“These vital services depend on a healthy, well-funded public sector. We must end the rorting of consultants and the endless outsourcing of government services to private contractors.

“The way to get value for money and to ensure adequate services is to build capacity in the public service. We need assurances from Labor that the reduction in spending on external contractors will actually reduce the government’s reliance on consultants.”